Download PDF (1.27 MB)

On behalf of the TPB staff and Board, I am pleased to contribute to this corporate plan with the Australian Taxation Office (ATO) and Australian Charities and Not-for-profits Commission (ACNC).

The TPB’s work supports public trust and confidence in the integrity of the tax profession and tax system. In the past 2 years, we have seen significant reforms shaped by the 2019 independent review led by Keith James, the government’s response to the PwC tax leaks scandal, parliamentary reviews and recommendations. We have worked closely with the tax profession to support the government’s priorities and reforms with a view to improving professional standards and addressing misconduct where it occurs.

The tax community has engaged in the reform process through ongoing consultation and communication. Tax practitioners are implementing these changes by exercising good judgment and the TPB has benefitted from increased transparency.

The tax profession continues to review and improve services and is committed to ongoing improvement. This includes tax practitioners engaging with clients, the TPB, and the ATO in a transparent and cooperative way.

The TPB’s key activities in 2025–26 will focus on:

- delivering a proportionate, fair and data-driven risk-based compliance program

- supporting tax practitioners and the public

- contributing to and informing the tax and regulatory system

- enhancing our capabilities.

To promote and support voluntary compliance and ensure a level playing field for ethical tax practitioners, we will publish our compliance priorities for 2025–26. These priorities are based on data, complaints, and key risks in our compliance program. Sharing our compliance priorities helps the tax profession to review and improve services, protecting their clients, practice, and the integrity of the profession.

In closing, I thank all our partners who contribute to a strong tax profession and fair tax system. The success of the TPB relies on the strong relationships and the dedicated contribution of our TPB team, our colleagues across government, tax professionals and professional associations.

Peter de Cure AM

Chair

Tax Practitioners Board

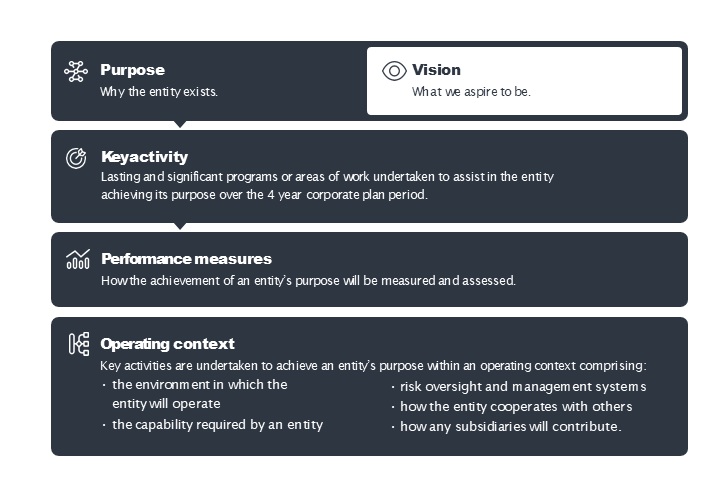

The key elements of our plan

The following diagram represents the key elements as required in a corporate plan under subsection 16E(2) of the PGPA Rule. In addition to these requirements, we have also included our vision.

Our purpose is to support public trust and confidence in the integrity of the tax profession and the tax system.

We will achieve this through the following key activity and measurement of our performance.

| Key activity | Performance measures |

|---|---|

| Increase trust and confidence in the tax and regulatory system by supporting the profession and taking proportionate action to address those practitioners who do the wrong thing. | Feedback Tax practitioner feedback. Risk assessment Proportion of completed risk assessments. Sanctions Sanctions are appropriate (subjective qualitative measure). |

Operating context

We are a small and agile agency with high levels of capability and staff engagement, supported by the ATO and APS framework.

Our team is proud of its strength in diversity, including 47% of staff identifying as culturally and linguistically diverse.

Workforce

Our success hinges on our people, and we are dedicated to supporting their wellbeing, engagement and growth.

As a small independent regulator, we play a crucial role in maintaining the integrity of the tax profession and the tax systems. To achieve this, we established a program to attract, develop and retain engaged and skilled staff. This includes expanding our compliance capability to address the law reform requirements and position ourselves as an effective regulator.

We have invested in our people and culture function creating a TPB-specific strategy that leverages our strong foundation as ATO employees. This ongoing work is focused on areas such as:

- staff engagement

- TPB culture development

- leadership and succession planning

- learning and development

- implementation plans to identify and address key issues arising from staff surveys.

Technology

We use contemporary systems and skilled people to meet our goals and improve our business.

We continue to modernise our internal and external application systems. The most recent improvements include our:

- Public Register

- Qualifications Advisory Service

- staff operating platform.

Our priorities for 2025–26 include:

- creating system features to help deliver the government’s reform agenda as it relates to tax practitioners and the TPB

- improving our services by recognising tax practitioners’ Australian Government digital identity in our dealings

- improving our technology through data-driven automation

- enhancing our security systems to address increasing cybersecurity risks, ensuring reliable services for all.

- enhancing our complaint and registration forms.

Data analytics and science

Data analytics and science empowers our team with trusted insights, enabling evidence-based decision-making, proactive risk management, process automation, self-service and continuous improvement.

Our priorities in 2025–26 include:

- using data-driven risk engines and measurement tools to identify systemic risks and measure the effectiveness of our strategies

- committing to a robust approach to data governance to promote high standards of data quality, security, privacy and ethics

- fostering a culture of data stewardship and continuous improvement to empower our people to use data responsibly and with confidence.

The profession

We support tax practitioners to uphold professional and ethical standards to strengthen public trust in the tax profession and system.

We acknowledge most tax practitioners act ethically and support their clients and the tax system. We will continue to strengthen our relationship with these tax practitioners by consulting with them and their professional bodies, collaborating to create guidance, and providing engagement through webinars and other activities. We are committed to supporting the tax profession as it faces economic pressures, technological changes, cybersecurity risks, and evolving client engagement methods.

Trusted relationships are essential as the tax profession helps millions of Australians and businesses with tax planning, lodgments, payments and advocacy.

Professional bodies continue to review practices for compliance, supported by TPB guidance. This continuous improvement and early engagement with regulators are crucial. Tax practitioners promptly addressing issues and maintaining open communication helps uphold the profession’s reputation.

Misconduct by some tax practitioners can harm community trust and system integrity. Some fail to exercise reasonable care, design tax avoidance schemes, or engage in fraud. We will use improved data analytics and risk assessment to take a balanced and proportionate approach to prevent and address misconduct, including by unregistered preparers. By addressing community concerns, parliamentary scrutiny and government reforms we will improve professional standards and integrity of the system.

Transparency and trust

Information volumes, enabled by new technology, can negatively impact information quality. Misinformation can further impact our society, creating disharmony and distrust. We acknowledge the challenge to improve trust in government and in our regulation, and with the tax profession and the tax system. We recognise stewardship of the system is especially important for a strong Australian community facing geo-political conflict, economic and trade uncertainty, digital disruption, challenges to social inclusion, and climate change.

We recognise that we must continue to innovate and improve support to the Australian community, tax practitioners, professional associations, the ATO and government. This innovation and collaboration will build confidence in a tax system that works to provide support and services for all Australians.

Compliance priorities

We will enhance transparency and publish its compliance priorities to improve voluntary compliance. These priorities will address systemic issues like tax fraud and shared risks such as personal tax obligations. We will also focus on strengthening tax payments, acting against promoters of tax schemes and unregistered preparers, and targeting professional misconduct to protect vulnerable Australians from financial abuse.

Our compliance priorities are informed by data analysis, stakeholder consultation and ongoing interactions with the tax profession. Last year, we received over 14,000 complaints and referrals about tax advisers, which helped shape our regulatory system.

Tax practitioners and professional associations provide valuable feedback and insights to us, informally and via structured consultation. Our priorities are also shaped by data, intelligence and risk assessments from the ATO and partner agencies.

We aim to level the playing field for ethical tax practitioners while other tax advisers will need to review and adjust their practices. Those who fail to address serious misconduct can expect targeted TPB action.

Professional conduct is also supported by educational services, guidance, and co-regulation by professional associations. Professional associations uphold standards, resolve complaints, supervise, investigate, and deal with members involved in serious misconduct, demonstrating their commitment to their members and the community.

In addressing their members' needs, services, performance and in the worst cases, misconduct, professional associations are demonstrating the delivery of their professional duties to their membership and to the community. We welcome increased transparency, feedback and advocacy from professional associations, who have shared goals in enhancing professional and systems integrity.

We are committed to working with stakeholders to deliver on our vision and purpose.

The profession includes:

- Tax practitioners – frequent engagement through public consultation, webinars and publications

- Members of the public

- Professional associations.

Government includes:

- Australian Taxation Office

- Treasury

- Australian Securities and Investments Commission

- Australian Transaction Reports and Analysis Centre

- National Disability Insurance Agency.

Consultation includes:

- Consultative Forums

- Engagement as outlined in the government’s reform agenda with the profession, associations, and other regulators.

Government

We are committed to supporting government priorities, including reforms to enhance tax system integrity.

The reform program announced in August 2023 has already delivered improvements to professional codes and standards, public information available on the TPB’s Register, and has excluded 'disqualified entities' (previously sanctioned for serious misconduct) from undermining the tax profession. Other changes have been subject to parliamentary recommendations and public consultation processes led by Treasury.

In March 2025, we welcomed announcements in the Federal Budget to enhance the TPB’s sanctions powers and registrations framework, proposed to start 1 July 2026 and 1 July 2027, respectively. The government will consult on details for implementing these changes, including safeguards to protect tax practitioners who do the right thing. Following passage of the law, we will consult on guidance material, giving clarity and transparency to tax practitioners and the public.

The profession and consultation

Reform is built on collaboration and cooperation with stakeholders. Therefore, we engage with tax practitioners, professional associations, education agencies, community and consumer representatives, as well as partner agencies.

Tax practitioners have a key voice in shaping reform and will continue to be supported by us in practical implementation. Our communication, guidance products and webinar programs will enhance awareness, provide useful case studies to support professional judgment, and build on continuous improvement and professional development.

In 2025–26, we will collaborate with professional associations to improve transparency and consultation by addressing feedback. We are committed to broad and ongoing dialogue, including environmental assessment of new risks and opportunities, considering reform options, discussing strategic issues and operational insights. We will work with Treasury and the ATO to further enhance consultation processes, confidentiality arrangements, active engagement from participants and will address duplication.

We will continue supporting tax practitioners to understand and comply with new Code Determination obligations and reforms through industry conferences, meetings with key tax practitioners, and discussions with professional association leaders.

We are focussed on lifting our regulatory performance, capability, and culture.

To achieve these improvements and comply with best practice, we have developed tailored performance monitoring and reporting processes.

Our key activities and performance measures directly support the accomplishment of the 3 principles of regulator best practice, as shown in the following table.

Regulator reporting

| Element | Continuous improvement and building trust | Risk-based and data-driven | Collaboration and engagement |

|---|---|---|---|

Key activity The number of relevant TPB submissions that aim to enhance our regulatory role and government coordination |  |  |  |

Stakeholders The profession |  |  |  |

Stakeholders Other government partners |  |  |  |

Stakeholders Consultation mechanisms |  |

|  |

Performance measures Tax practitioner feedback |  |  |  |

Performance measures Proportion of completed risk assessments |  |  |  |

Performance measures Sanctions are appropriate |  |  | |

| Regulator Statement of Intent |  |  |  |

Our Ministerial Statement of Expectations and Regulator Statement of Intent are publicly on the Treasury website.

Risk management

Our risk management strategy is maturing to better align with our legal responsibilities under the PGPA Act, and the Commonwealth Risk Management Policy.

Recognising our operational independence, we work in collaboration with the ATO’s Risk Framework, to improve cooperation in managing enterprise or higher priority risks that are shared across the tax profession and tax system.

This cooperative risk management approach recognises controls or mitigation strategies can be mutually beneficial, and addresses community expectations and requirements regarding delivery of an efficient, effective, economic and ethical public services.

Enterprise risks

| Enterprise risk | Risk description | Management strategy |

|---|---|---|

| Tax and superannuation performance influenced by tax advisers | There is a risk that the performance of the tax and superannuation systems declines due to regulatory system failure to uphold legal and professional standards of tax advisers. | We are managing this risk through supervision and compliance that is fair and proportionate to risks. This law and compliance program includes data analytics and intelligence, preventative early warning nudges, enquiries, investigations, sanctions and litigation. In 2025–26, we will encourage the level playing field, cooperation and transparency and voluntary compliance by providing guidance and publishing our compliance priorities. |

| Influencing policy and law design | There is a risk regarding the TPB’s capability and influence in shaping policy and law design, with regulatory or integrity gaps undermining community confidence. | We are managing this risk by providing advice to Treasury and government and we work closely with the ATO. TPB views on policy, law, guidance and administration are shaped by consultation and coordination with stakeholders, especially the community, tax profession, professional and educational providers. |

| End‑to‑end client services | There is a risk that the TPB does not deliver efficient and effective stakeholder services to the community and to tax practitioners, undermining confidence in the TPB and the regulatory and tax systems. | We are managing this risk by understanding tax practitioner needs and their professional 'lifecycle' to maximise TPB support with community awareness, registration standards (education, experience, ethics), practical guidance products, continuing professional education, appropriate supervision and leveraged compliance strategies. Public support includes our Law & Compliance program to uphold professional standards, Client Support program to advise clients impacted by sanctions that have been applied to tax practitioners, and transparency via the TPB Register supporting informed engagement and decision making. |

| Enabling technology and systems | There is a risk that the TPB is unable to develop and maintain a contemporary suite of technologies for the community and staff caused by rapid changes in the broader technology environment, demand pressures, funding constraints and competition for skilled resources, resulting in degradation to the security, reliability and usability of the technology services that support the effective management of our services. | We are managing this risk by understanding the technological needs of our staff, tax practitioners and the public and prioritising our investment into technology to service those needs. The TPB will respond to system incidents in an effective and timely manner and make enhancements if required as part of our priority agenda. |

| Data governance | There is a risk that the TPB does not access, use or manage data lawfully and effectively, failing to detect and treat risks, drive digital innovation, and assess and report on effectiveness, resulting in undermining confidence in the TPB and the regulatory and tax system. | We are managing this risk by prioritising data governance, lawful sharing of data and systems with the ATO and partners, risk, measurement and reporting systems built on data analytics and science. |

| Cybersecurity | There is a risk that the confidentiality, integrity, or availability of TPB information systems is compromised by an external threat actor or malicious insiders, resulting in direct and indirect financial impacts, the undermining of trust in the TPB and government. | We are managing this risk by working with the ATO and ensuring our cybersecurity capabilities meet whole of government requirements. |

| Registration integrity | There is a risk that TPB registration processes lack integrity, tax practitioners are registered lacking education, experience or ethical standards, adversely impacting tax or superannuation outcomes for clients and the community, resulting in undermining confidence in the TPB, tax system and profession. | We are managing this risk through improvements to TPB support over the tax practitioner lifecycle, including proof of identity, risk assessments (disqualified entities, significant breach reports, personal tax obligations), annual registration attestation, ATO coordination in fraud detection and TPB compliance improvements. |

Plan Notes

This TPB plan is an excerpt from the Australian Taxation Office corporate plan 2025–26, covering the period 2025–26 to 2028–29.

Last modified: 18 August 2025